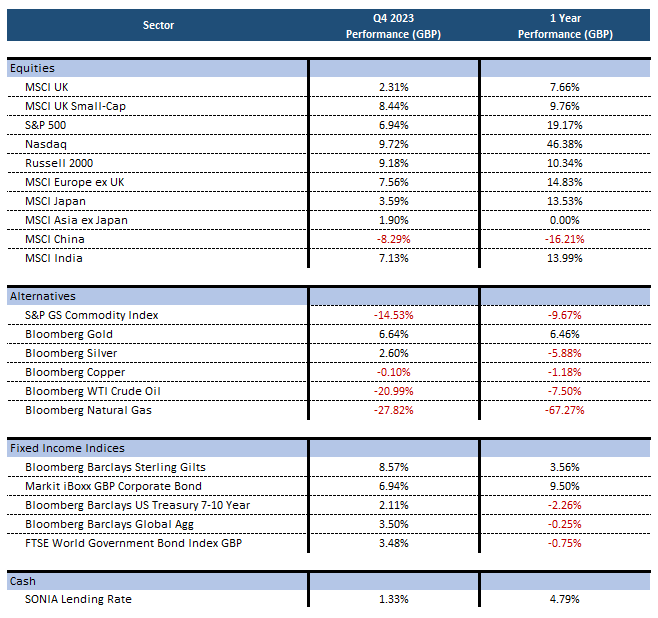

Stock and bond markets finished the year on a high with all main asset classes posting strong returns in the last quarter of 2023. The UK aggregate bond market was up 8.25% and most equity markets rallied by 5% or more in GBP. The main factors driving financial markets continue to be the level of inflation and the outlook for interest rates in the US, UK, and Europe.

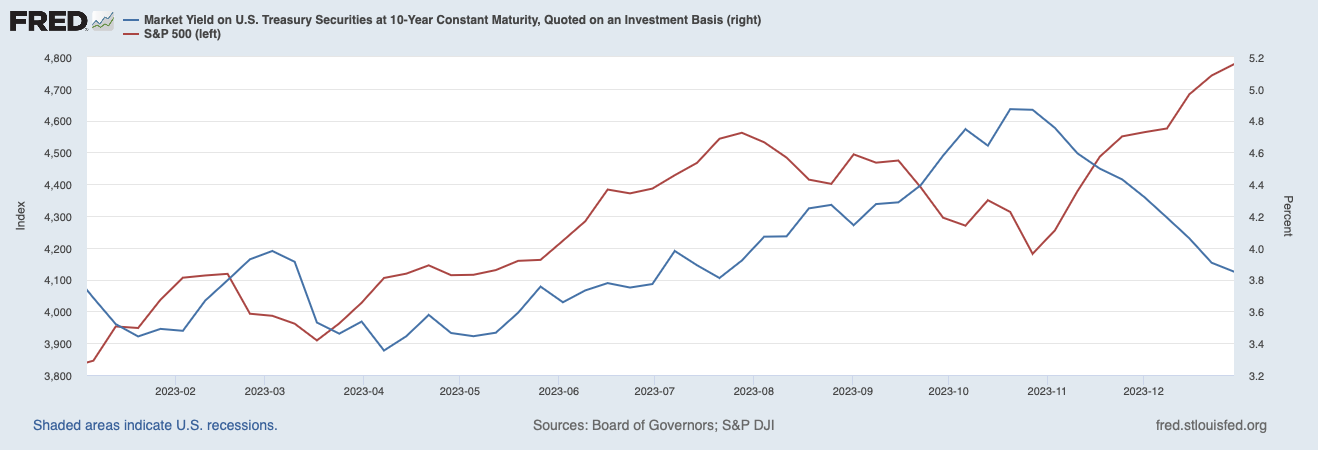

During the third quarter, as core inflation remained elevated, the Federal Reserve and other Central Banks warned that interest rates would need to stay higher for longer. In the US, this led to a rise in the 10-year US Treasury yield to close to 5% and a 10% decline in the stock market (S&P500) between the end of July and the end of October. From early November, core inflation figures started to come down quicker than expected and there were signs that the US labour market was cooling. This meant that further rises in interest rates were unlikely and that the US Federal Reserve could soon pivot to reducing interest rates. This led to the 10-year US Treasury yield falling back to 3.9% by the end of 2023 and the S&P500 rallying by 14%. There was a similar dynamic in the UK and the Eurozone.

The market rally accelerated in December when the Federal Reserve (Fed) President, Jerome Powell confirmed that the Fed would consider cutting interest rates in 2024. The broad market rally was driven by expectations that the US economy would be able to achieve a ‘soft landing’, i.e. the economy slowing down sufficiently for inflation to come down towards its 2% long-term target allowing for interest rates to be cut before they trigger a recession or major job losses.

The market expectations are for interest rates to fall by 150 basis points down to around 3.75% to 4% by the end of 2024. The Federal Reserve’s own projections is for interest rates to come down by 75 basis points in 2024 to 4.5% to 4.75%. If the US economy continues to perform relatively well, the Federal Reserve is unlikely to reduce interest rates quickly given the risk that inflation could pick up again. Interest rates are only likely to come down in line with market expectations if the economy slows down more than expected. This scenario would not be positive for equities as earnings expectations would most likely have to come down from current level.

The S&P500 companies are currently forecast by analysts to raise earnings by 11.8% in 2024, above the average earnings growth rate in the past 10 years of 8.4%. This scenario seems optimistic given that companies are facing higher interest rates, higher input costs due to inflation and slower demand.

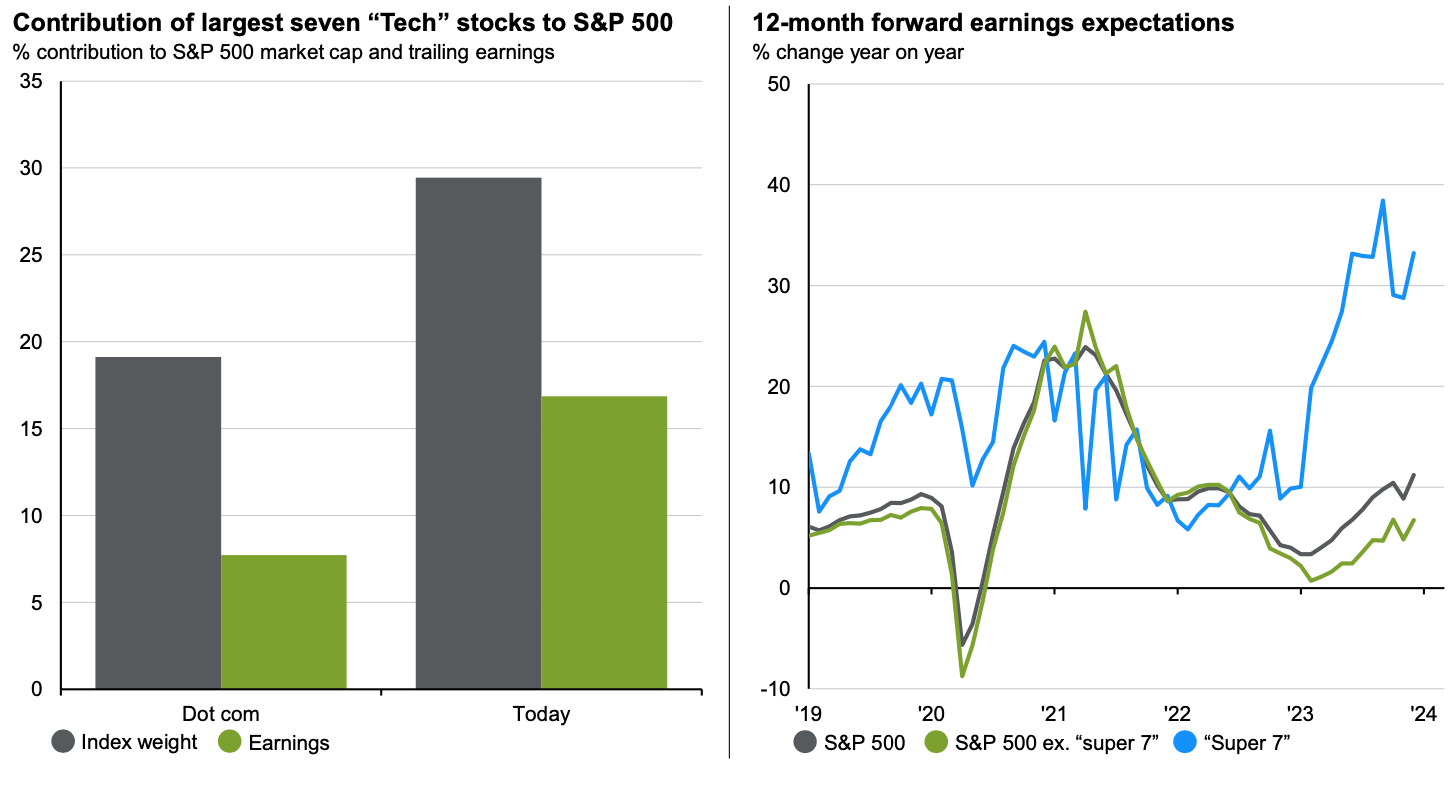

On the other hand, a significant share of the earnings growth is expected to come from the so-called ‘Magnificent Seven’ namely Microsoft, Meta, Amazon, Apple, NVIDIA, Alphabet and Tesla which are expected to growth their earnings by close to 35% in 2024 whereas the rest of the US market is only expected to grow earnings by 6% to 7%.

The US market is increasingly dominated by these seven large companies. They now account for close to 30% of the total market value of the S&P500 and contributed to close to half of the S&P500 2023 performance. The stellar performance of the S&P500 in 2023 can in large part be explained by the performance of these seven companies. Such high level of concentration adds to risks both on the upside and downside.

Source: JP Morgan Asset Management – Guide to the Market UK Q1 2024

In our view, the outlook for the US economy and the US equity market may be over optimistic given the lagged effect of rising interest rates. US interest rates only peaked in August 2023 and it’s not clear when the full effect of the higher interest rates will show in the economy especially as the US economy has been protected from higher interest rates by generous fiscal programmes and the excess savings accumulated during Covid.

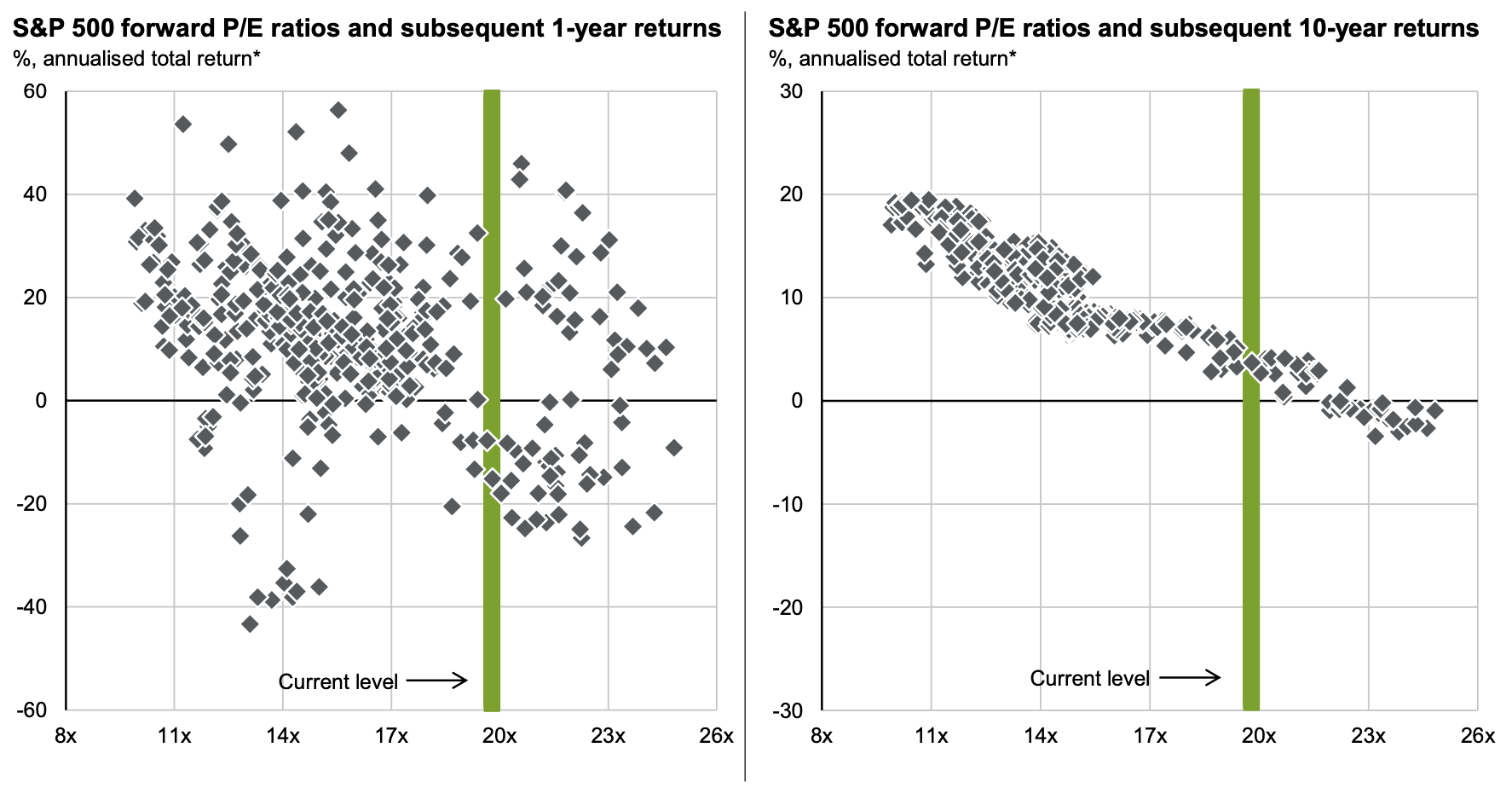

JP Morgan’s research shows that given the current market valuation, the US stock market is unlikely to post strong returns over the next 10 years. The graph below shows the range of returns achieved by the S&P500 over the following year (graph on the left) and over the following 10 years (graph on the right) given different starting valuation levels. As the graphs show, at the current valuation, the subsequent 10-year annualised returns for the S&P500 have historically ranged between -4% and +5%.

Source: JP Morgan Asset Management – Guide to the Market UK Q1 2024

Most markets posted strong returns in 2023. The most notable exception was the Chinese equity market which continued to fall in the last quarter and is now down more than 50% in the past 3 years. The Chinese government is taking actions to boost the economy but so far, most measures have been limited and the economy remains weak in the face of continuing structural problems in the real estate sector. The government may need to take bold measures to kick start the economy such as restructuring the real estate debt or launching a major stimulus programme. Despite the sluggishness of its economy, China is still expected to grow its economy by 4.5% in 2024. The combination of negative factors and negative sentiment means that the Chinese market is likely to be oversold.

The Chinese equity market currently trades close to its lowest level in 12 years, at a multiple of 9.3 times earnings compared to the US market trading at 19.7 times earnings and other developed markets trading at 13.0 times earnings. Given that China is the world’s second largest economy and that the country boasts several large innovative companies in fast growing sectors such as technology and renewable energy, we believe the current market valuation provides a good entry point for opportunistic long-term investors.

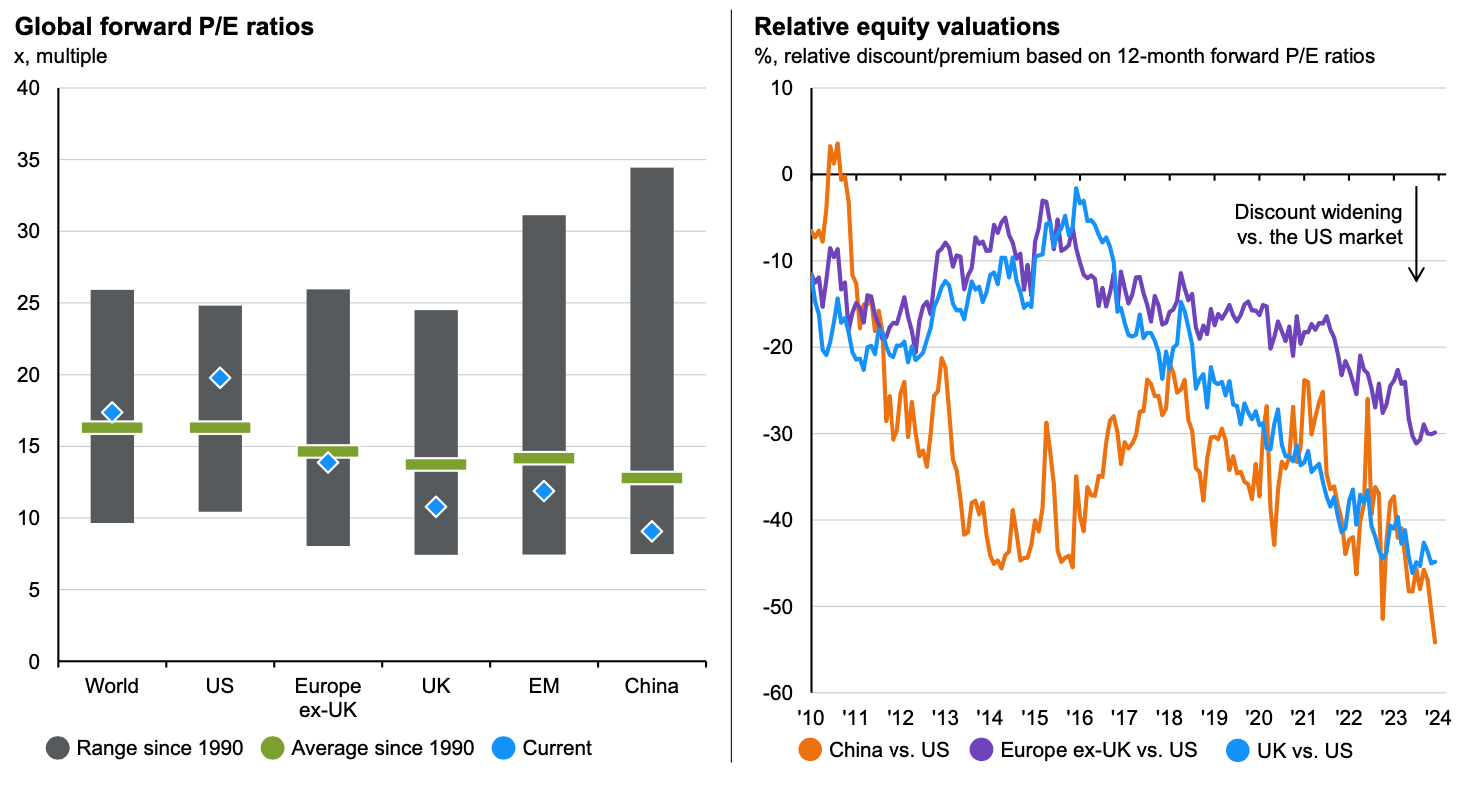

In summary, although the US economy continues to perform better and be more resilient than other economies, we remain cautious about US equity valuations. Valuations in other developed markets are generally reasonable and in line with historical averages with some markets such as the UK and China trading at historical low levels as shown in the charts below.

Source: JP Morgan Asset Management – Guide to the Market UK Q1 2024

We continue to follow the same strategy as in 2023. Given the risk of a global economic slowdown triggered by the lagged effect of higher interest rates and less generous fiscal spending, we are underweight equities and overweight investment grade fixed income.

Index Returns

The information in this document does not constitute advice or a recommendation and is for the information of the recipient only. Past performance is not a reliable indicator of future returns. The value of investments and the income derived from them can go down as well as up and you may not get back the amount invested. PK Wealth Ltd is a limited company registered in England and Wales (number 08991126) and is authorised and regulated by the Financial Conduct Authority.

If you have any questions, please do contact us via welcome@pkgroup.co.uk or on +44 (0)20 8334 9953? We are here to help.