As you are aware, Labour have been victorious in winning the General Election 2024. We have prepared an overview which highlights what the main parties are saying about tax.

Both the Conservative and Labour parties have pledged not to increase income tax, national insurance or VAT, although the Labour party have pledged to introduce VAT on private school fees. Both parties are also committed to clamping down on tax avoidance and evasion which they claim will fund their spending plans. Both of the main parties also claim that removing the remittance basis for non-Doms will also yield more tax revenue, although Labour propose to plug loopholes in the Conservative plans.

One tax measure not matched by Labour is the Conservative proposal to raise the personal allowance for pensioners in line with the State Pension triple lock so that none of the State Pension is subject to income tax. That is clearly aimed at attracting the “grey” vote. Ironically the Age-related personal allowance was abolished by the Conservatives.

A further announcement in the Conservative party manifesto is a permanent extension of SDLT first time buyer relief. If this relief applies, there is no SDLT where the purchase price is no more than £425,000 and 5% thereafter. The relief does not apply where the purchase price is more than £625,000. SDLT first time buyer relief is currently scheduled to end on 1 April 2025.

A measure in the property section of the Conservative manifesto that lacks detail is a proposed 2 year CGT relief where a landlord sells a rental property to the tenant.

The Conservatives claim to be able to save £20bn by making “efficiencies” in the Civil Service – let’s hope that doesn’t mean reducing HMRC staff any further, as customer service is currently appalling.

Labour claim that their proposal to close the “carried interest” tax loophole for general partners in the private equity and venture capital sector will raise £565 million. Such returns are currently subject to CGT at 18% or 28%. This possibly means subjecting carried interest to income tax or aligning CGT rates with income tax rates. However there is no mention of changes to the rates of CGT generally.

In Scotland, the SNP’s manifesto says that they will demand the full devolution of tax powers, including over National Insurance, windfall taxation for companies and to crack down on tax avoidance and evasion. The party will support the reform of VAT to address imbalances in the rating system, including ending the VAT exemption for private schools and introducing a lower VAT rate for hospitality and tourism sectors.

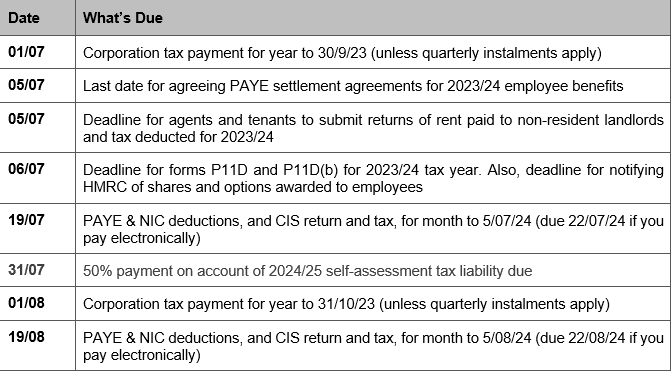

Diary of main tax events

July/August 2024

If you have any questions regarding the General Election 2024, please get in touch via welcome@pkgroup.co.uk or on +44 (0)20 8334 9953.