The UK government has recently published changes to legislation that increase the monetary size thresholds that are applied when determining whether your business qualifies as a micro, small or medium-sized entity. The changes come in to effect on 6 April 2025 and apply to companies and limited liability partnerships registered in the United Kingdom, and those forming part of a group.

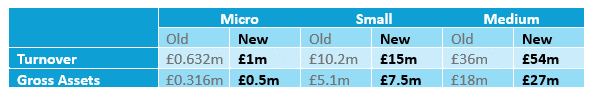

With effect from the above date, the new size thresholds will be:

There are no changes to the employee numbers, which remain as follows:

- Micro entities: 10

- Small entities: 50

- Medium sized entities: 250

For these purposes, gross assets mean fixed assets plus current assets, but excluding short and long-term liabilities.

Higher financial limits may be applied when considering a parent company and group, those higher limits incorporating inter-group trade and balances.

Two of the three qualifying criteria must be meet in either the first ever financial year or for two consecutive financial years. The qualitative factors used to establish whether an entity or group is excluded because of the nature of its activities remain unchanged.

Transitional rules are included in the legislation which allow entities to apply the new thresholds to the comparative period when preparing the first set of accounts covering a financial year beginning on or after 6 April 2025. As a result, companies, groups and limited liability partnerships may benefit from the threshold uplift as soon as possible after the legislation comes into effect.

The uplift in thresholds will potentially enable companies, groups and limited liability partnerships to reduced their corporate reporting. Whilst those changes may be welcome, we would encourage you to discuss your business’s circumstances with PK Group’s Professional Services team in advance of any change.

If you have any questions, please do not hesitate to contact us via welcome@pkgroup.co.uk or on +44 (0)20 8334 9953.