online automated investment service.

KLIKINVEST

Access to an efficient investment experience for your long-term wealth and savings.

You can open a SIPP, ISA or General Investment Account (GIA) using a simple online application process.

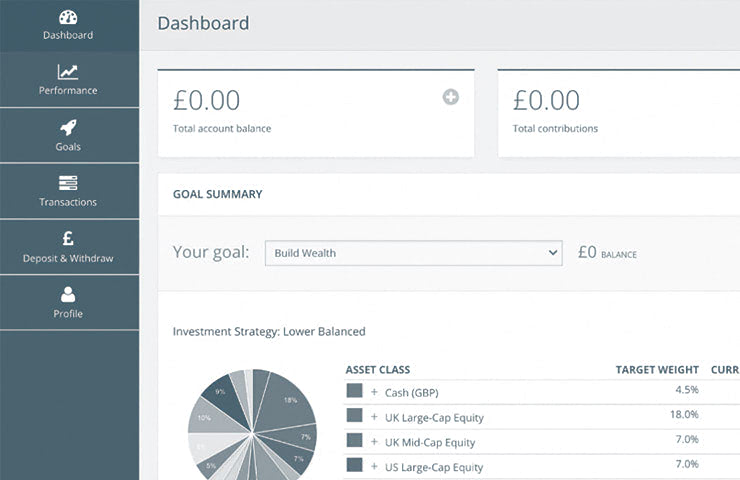

KlikInvest offers nine risk rated low cost investment strategies. The portfolios invest in a variety of globally diversified funds and ETFs are a substantial part of the KilkInvest investment universe.

3 STEPS TO KLIKINVEST

Complete our online questionnaire

The KlikInvest risk assessment process asks questions covering your attitude to risk, approach to investing, investment knowledge and financial situation.

Based on your answers, KlikInvest will select a portfolio strategy appropriate to your attitude to risk and financial situation.

Choose from an ISA, SIPP or GIA

There are three investment wrappers available on the KlikInvest platform: an ISA for tax efficient investments, a SIPP for pensions, and a General Investment Account (GIA).

After you have selected from one of these three options, create your account for online access and select your investment goals.

Fund your account…the rest is up to us!

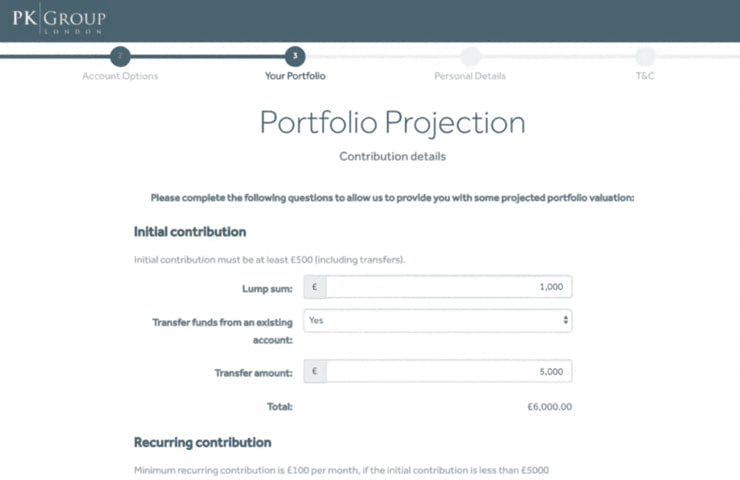

Once you have funded your account through a bank transfer, KlikInvest will automatically invest into your allocated portfolio.

You can view your portfolio and manage your KlikInvest account online 24/7 via smartphone, tablet or computer.

Please be aware that the price and value of your investment can fall as well as rise, and past performance of any fund or investment should not be treated as a guide to future returns. Also, if you have any doubts about the appropriateness of this service to your personal and financial circumstances, you should seek independent financial advice for which additional charges may apply.

Our Products

KLIKINVEST OVERVIEW

Opening accounts

You can open various types of account such as a General Investment Account (GIA), Self-Invested Personal Pension (SIPP) and Individual Savings Account (ISA) via the website.

Please be aware that the price and value of your investments can fall as well as rise, and past performance of any fund or investment should not be treated as a guide to future returns.

Costs Involved

One single charge between 0.74% and 1.00% including VAT based on how much is invested. Indicative cost will be available during the signup process once we know how much is being invested.

Competitive ongoing cost on underlying holdings, typically between 0.15% - 0.25%.

No setup, exit or transaction charges.

If you are using a financial adviser, please speak to them before you sign up as additional charges may apply.

Sufficiency of Funds

Before committing to any investment, you should be certain that your immediate needs have been provided for. This means that you:

Have adequate access to emergency funds.

Do not have existing debts that you would be better paying off.

Have insurance to protect your family.