In the first quarter of 2023, it was anticipated that planned interest rate rises in the US, UK & Europe would be sufficient to apply downward pressure on inflation. This scenario played out in the first few months of the year with headline US Consumer Price Inflation (CPI) falling from 6.4%pa in January to 3.0%pa in June.

However, the US economy remained strong with GDP growth of 2.4% in Q2 2023. The Citibank Economic Surprise Index, which rises when data comes in stronger than expected, moved to its highest point since early 2021, reflecting strength in retail sales and industrial production.

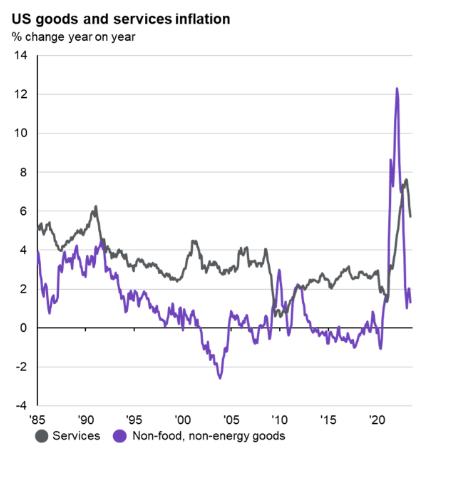

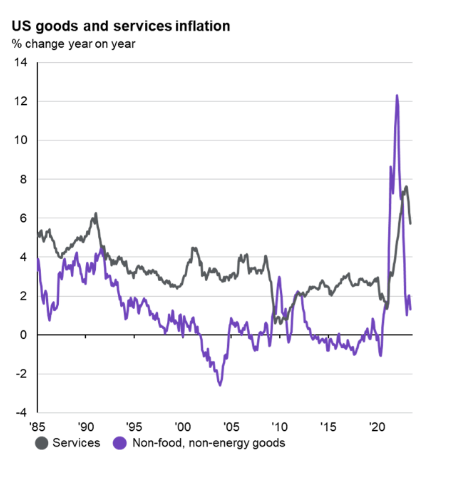

This economic resilience showed up in persistent US Core CPI numbers which fell from 5.6%pa in January 2023 to only 4.7%pa in July, versus a government target of 2.0%pa. Manufacturing, energy and food sectors were weaker but the service sector including retail, hotels, restaurants, transport, rents, support services remained strong. US service sector price inflation rose from 7.2% in June to 7.4% in July, the highest rate since 1992.

In the UK and Europe July Core CPI numbers came in at 6.9%pa and 5.5%pa respectively against the same target as in the US of 2.0%pa.

Labour markets also remained tight with average hourly earnings in the US rising 4.4% over the year to July. In the UK the equivalent figure rose by 7.3%pa, the highest growth number on record. The arising concern was that stronger economic growth could risk a second wave of inflation with interest rates staying higher for longer.

Markets

Due to the stronger economic background and lack of progress on reducing Core CPI numbers, investors pushed out expectations of interest rate cuts by approximately six months. In the US, markets are now anticipating reductions towards the middle of 2024 which has forced a revision of return expectations.

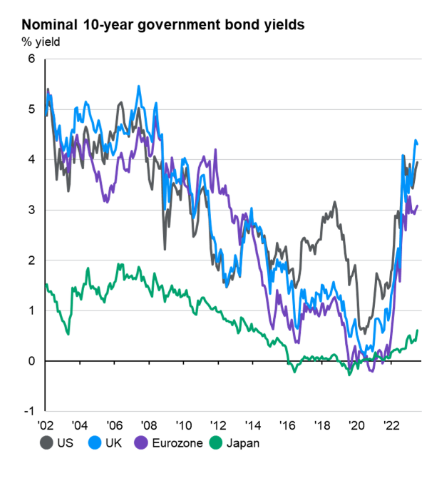

Bond markets have seen an increase in US 10-year bond yields from 3.4% in May to a current level of 4.3% (as bond yields go up prices fall). Over the same period UK 10-year yields have risen from 3.6% to 4.6% and in Europe yields have increased from 3.1% to 3.4%.

Fueling the uptick in yields has been a sharp increase in government bond supply. The US treasury announced last month it expected to issue a net $1tr worth of bonds in the three months between July and September to make up for declining tax revenue. This is at the same time as a downgrade in US debt from Fitch moving the rating one notch lower from AAA down to AA+ based on concerns over the debt burden.

In the equity market, highly valued stocks have become more vulnerable given the increasing attractions of higher income yields in the risk-free government bond sector. The impact on US technology stocks has been noticeable with the Nasdaq Index having fallen approx. 4.5% over the last four weeks. Consumer focused stocks are also under pressure given the increased cost of living.

China

China is the only major economy in the world which is in a deflationary cycle. It is experiencing some of the slowdown problems likely to impact the US, UK & Europe over the next six months as part of the process required to bring down inflation. The inflation reading in China came in at minus 0.3% in July showing a significant gap with western economies.

Beijing has a number of issues to deal with including a weak property market, disappointing consumer spending, weak exports and youth unemployment. The government has now gone into stimulus mode reducing interest rates a number of times over the last six months. Ideally the Peoples Bank of China would like to cut interest rates without renminbi depreciation, but given the strong dollar and high level of US interest rates, it is difficult to move aggressively.

The China Securities Regulatory Commission have also revealed a package of reforms to boost investment in stock and bond markets including extending trading hours, cutting dealing fees for brokers and encouraging share buy backs to help stabilize prices. These reforms are expected to help in the short term and are consistent with achieving an economic growth target of 5.0% for the calendar year 2023.

Price cuts in China do seem to be propping up exports and could help to reduce inflation in western economies. Weak Chinese demand could also keep a lid on commodity prices, in particular oil, up 20% since June. How strongly China stimulates their slowing economy could have an impact on developments in global markets.

Conclusion

It is clear from the above that a period of economic slowdown is required in US, UK and European economies to get inflation back down towards a common target of 2.0%pa. This will involve negative adjustments to corporate profits and some downgrades in credit ratings.

With slowing growth and some upward pressure on bond yields from higher interest rates for longer, it is reasonable to expect further weakness in both equity and bond markets over the next six months. In all risk profiles we are holding below long-term average exposure to equities with our biggest overweight in government/corporate bonds. This positioning should provide some cover against increasing volatility over the next few months.

Portfolio returns have been reasonably robust year to date ranging from 1.36% to 1.96% depending on risk profile. Our strategy, as mentioned in previous quarterly valuation letters, is to add to equities on weakness over the next six months. We followed the same strategy in March 2020 when equity markets fell on confirmation of the Covid pandemic. This strategy delivered noteable outperformance versus peer group in the market recovery that followed.

We remain positive on our current asset allocation across all portfolio types and risk profiles expecting a peak in the interest rate cycle towards the end of this year. This in turn should produce a more positive background for risk assets towards the middle of 2024.

Get in touch

If you have any questions, we are happy to help. You can contact us at investments@pkgroup.co.uk or via +44 (0)20 8334 9953

The information in this document does not constitute advice or a recommendation and is for the information of the recipient only. Past performance is not a reliable indicator of future returns. The value of investments and the income derived from them can go down as well as up and you may not get back the amount invested. PK Wealth Ltd is a limited company registered in England and Wales (number 08991126) and is authorised and regulated by the Financial Conduct Authority.