Introduction

The rapid and steady increase in the Bank of England Base rate starting late 2021 was intended to reduce inflation by making it more expensive to borrow money. As the Bank of England Base rate increased, so did mortgage rates.

Overview

The average UK inflation rate during 2022 was around 9.07%, falling a little to 7.3% in 2023 and to 2.5% in 2024. With these reductions in the rate of inflation, the Bank of England have been able to reduce the base rate – from 5.25% to 5% in August 2024. In November, it was lowered further to 4.75%, and in February 2025, it was cut again to 4.5%.

Comments from the governor of the Bank of England, Andrew Bailey, point towards further reductions over time. However, it depends on how economic conditions evolve.

The Bank of England review interest rates approximately every six weeks, assessing the state of the economy, recent global trends, and forecasts for the months ahead. Key factors we consider include:

- The rate at which prices are rising

- The growth of the UK economy

- Employment levels

PK’s Chief Investment Officer, Michael Usher comments “Markets are currently expecting a further two or three interest rate cuts this year, which could see rates fall below 4.0% by the end of Q4 2024, assuming inflation remains close to target of 2.0%. This expectation is consistent with a lower UK growth outlook for 2025, recently cut by the Bank of England to 0.75%. Economic growth expectations for 2026 and 2027 have been revised up to 1.5% as the positive impact of lower interest rates starts to feed through.”

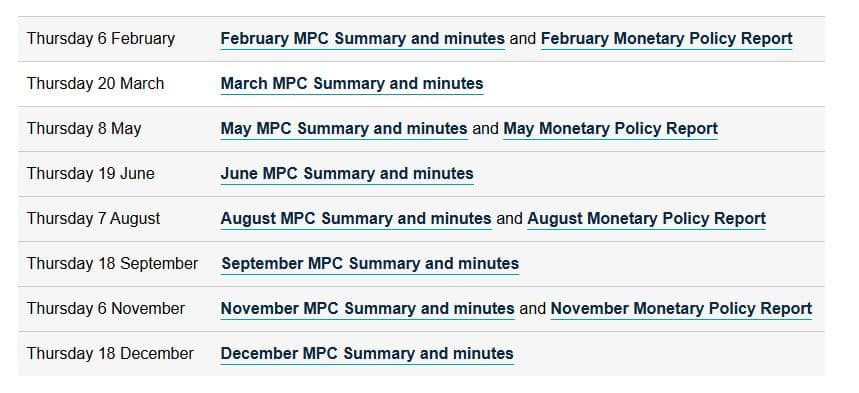

We’re in for an interesting year ahead. Did you know that the next interest rate decision will be announced on Thursday, 20 March 2025? You can find a full schedule of important upcoming dates here:

Contact us

If you would like to find out more, please feel free to contact Jonathan Birkett, our Equity Release and Mortgage Adviser. Whether you’re a first-time buyer or seeking competitive re-mortgage rates, Jonathan is ready to assist you. You can contact him via email at jonathan.birkett@pkgroup.co.uk or by phone at +44 (0)20 8334 9953

PK FINANCIAL PLANNING LLP is authorised and regulated by the Financial Conduct Authority (‘FCA’), 12 Endeavour Square, London E20 1JN. Your home is at risk if you do not keep up repayments on a mortgage secured on it.