What is MTD for IT?

Making Tax Digital for Income Tax has been designed to increase the efficiency of the tax system. It will require self-employed businesses and landlords with qualifying income to maintain digital records and update HMRC each quarter using compatible software. It will be phased in from April 2026.

For these purposes, qualifying income is the sum of the amounts of income, before any deductions, which are included in your self-assessment tax return for the relevant year.

Who it will affect from April 2026?

- You’re an individual registered for self-assessment.

- You receive income from self-employment or land and property, or both.

- Your qualifying income is more than £50,000.

Who it will affect from April 2027?

As above but now with the reduced qualifying income of £30,000. All those qualifying will be mandated to Join MTD IT from April 2027.

Who will it not apply to?

- Partnerships (expected start date not yet announced).

- Trusts, estates, trustees of registered pension schemes and non-resident companies.

- Taxpayers domiciled or resident outside the UK in respect of their relevant foreign income.

- Limited companies and LLP’s (expected start date not yet announced).

How will you know if it affects you?

- You will need to submit your 24/25 Self-Assessment return by 31st January 2026.

- HMRC will review your return and check if your qualifying income is more than £50,000.

- HMRC will write to you and confirm that you must start Making Tax Digital for IT by 6th April 2026.

What you will be required to do?

- Maintain digital accounting records in a software product or on a spreadsheet to be uploaded with bridging software.

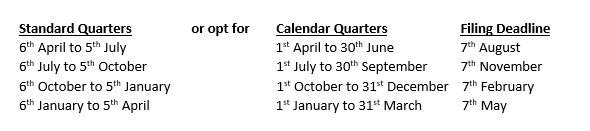

- Submit quarterly returns to HMRC and finalise your tax position after the end of the tax year.

- Acquire a suitable commercial software product or appoint an agent to submit information to HMRC on your behalf.

- Separate quarterly updates will be required for each business. So, for an individual operating as a sole trader who also has a land & property business you will need to submit eight quarterly returns.

- After all four quarters are filed, you will be required to file a digital tax return which will be populated from the four quarters submitted previously and adjusted for accounting and tax purposes.

- Missing a filing deadline will result in points being allocated. Points will accumulate until a threshold is reached, at which point a £200 penalty will be issued. From that point onwards, any further late submissions will result in an immediate £200 penalty.

What’s not changing?

The payment dates for tax will remain the same – Tax payable by 31st January following the end of each tax year, with payments on account payable for the following year by 31st January and 31st July where relevant.

This article reflects the law in force as at 5th November 2024 together with announcements made on 30th October 2024. Further changes may be made prior to 6th April 2026.

Do you think this affects you, get in touch today?

PK Group’s Professional Services team are ready to support you for preparing and implementing MTD IT.

Please don’t hesitate to contact us via welcome@pkgroup.co.uk or by phone on +44 (0)20 8334 9953