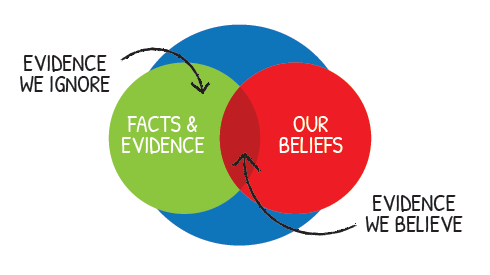

Confirmation bias is when individuals have an unconscious tendency to look for information that supports their pre-existing beliefs.

They then ignore or discount information that opposes those beliefs.

Why does it matter?

Confirmation bias can lead investors to deliberately search for information that validates their investment choices while neglecting information that contradicts their decisions. This can lead to poor investment decisions.

An example could be a client who is resolute on owning shares in a particular company, perhaps they or a family member worked there, creating an emotional attachment.

If the share price of this company declines, the client may consider it as normal market volatility, despite the possibility that the market may have risen on that day when the stock price fell. However, every time the share price of the company rises, it reinforces the client’s confidence in the stock. The bias is driven by the client’s beliefs rather than available evidence.

Help clients overcome this

Communicating openly with your client and helping them to recognise Confirmation Bias is the first step.

Ask questions about their investment beliefs, and understanding their position will enable you to present a range of alternative perspectives.

This will then help you to;

- Present a variety of opinions and evidence to challenge their bias

- Focus on their investment goals, not investments

- Take the long term view to investing

- Educate them on key investment principles

This approach will not only provide better client outcomes but also foster stronger relationships and enhance long-term retention.

Get in touch

Do you have any questions? We are more than happy to help. You can contact us at welcome@pkgroup.co.uk or via +44 (0)20 8334 9953

The information in this document does not constitute advice or a recommendation and is for the information of the recipient only. Past performance is not a reliable indicator of future returns. The value of investments and the income derived from them can go down as well as up and you may not get back the amount invested. PK Wealth Ltd and PK Financial Planning LLP are authorised and regulated by the Financial Conduct Authority.

This content was originally published by EBI. Please visit EBI’s website for more information.